Why everything is confusing Part 1: Market Disruption

It is almost impossible nowadays to participate in a Technology conversation, event or idea without hearing the words “autonomous” and “mobility”. Whether that is face-to-face, digital (the #AutonomousVehicles hashtag is equally prevalent) or on paper, CAV is undoubtedly the “talk of the town” for the past few years and that is a trend that only seems to be generating more and more interest. In the last 6 to 12 months, investment in the technology has grown and hence interest and awareness has also exponentially increased consequently creating a vibrant and active debate about autonomous vehicles.

This movement in the market is very promising as we are already starting to see that we have some early adopters of the technology that believe it could have a real use and major impact in our future. Nonetheless, like every new technology, concept or idea, it also has its opposers mainly due to the confusion caused as to what the actual best solutions are.

As there are a lot of factors that contributing to the confusion in the marketplace, Y-mobility will be releasing a series of 5 articles titled: MACV (Mobility Connected Autonomous Vehicles): Why everything is confusing” were we will be providing our views in some of the key areas that are creating this confusion.

In this article, Part 1: Market Disruption we will try to explain the actual current market situation, how we got to this point, why the market is disruptive and how this disruption is creating “confusion”.

The statements in these articles are base in facts from the market and others on our views base in best practices of innovation and our experience. If any of the readers disagree in some of our statements please contact us in dfidalgo@y-mobility.co.uk we would be more than happy to discuss and clarify any of your queries.

The Law of Diffusion of Innovation:

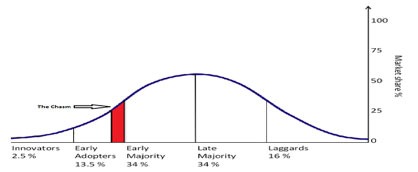

First at all, let’s go back to a simple tool I personally use and that explains human nature and innovation propagation, better than none. I Initially discovered this back in the early 2000s from Simon Sinek’s TED Talk video called “The law of diffusion of innovation”. Most people with a marketing background have heard of this at least once but for the purpose of understanding the current technology disruption it also comes in very handy.

As is demonstrated above, the curve is a standard bell that is split up into different segments:

InnovatorsEarly adoptersEarly MajorityLate MajorityLaggardsThere’s also The Chasm (marked in red) – described as the tipping point before the mass market accepts any product and it sits snugly between the early adopters and the early majority. Until your product reaches the tipping point, you have not achieved mass market penetration.

Now consider this – there are 3 types of people in this world:

The ones who play the gameThe ones who watch the gameThe ones who have no idea that the game is being playedIf you apply the above statement on top of the diffusion of innovation theory, right before the tipping point:

Innovators – The ones who play the gameEarly adopters – The ones who play the gameEarly Majority – The ones who watch the gameLate Majority – The ones who watch the gameLaggards – The ones who have no idea that the game is being playedFrom this, it Is not that easy to understand who is in what sector in the tech industry, but it helps us to define what people are in the difference categories. As an example, in an OEM & Tier1 you can find all this level of individuals, from innovators to Laggards that do not believe in the technology or the Early Majority, the ones that watch the game without any team to support. Same range of individuals can also be found in the Investment community.

According to the theory, the best approach to accelerate the acceptance of the technology is achieving the tipping point (the charms). So converting the early majority into early adopters. Commonly, business practices nowadays would advise that the best way to do this is by develop marketing campaigns that support the product roadmap and financial business plans to target innovators and early adopter clients that can support a company to move to an early majority.

As a theory, it most definitely makes quite a lot of sense. The basic concept is: Have a good product & strategic roadmap, good marketing and brand strategy and a good financial plan to overcome the first stages of developing a product and manage to get to the tipping point in a “healthy” stage in order to grow.

It is hence imperative to first get a better comprehension of CAV and Mobility markets in order to attempt to apply the same simple theory.

CAV & Mobility Market:

The markets are driven by people and in a global economy the evolution of society though technology is the key enabler to change society and technology as we know it. How we communicate, move and behave is driven by the markets and the ability to provide humans benefits.

Let’s perform a little “recap” to get an understanding of where the industry is and how it has developed through the past 20 years.

Early 2000’s: The .com era. The era of the Internet, globalization and technological innovation. Apple. Microsoft, Google, Nokia, Yahoo, AOL, Explorer, Facebook and many others. For the first time in history, society – collectively - was able to break the “distance” barrier which allowed us to start communicating with one another, sharing views and changing our perception of products, services and ideas worldwide. I call this the beginning of the Software era, as everything started based on Moore's Law which solidified itself as the golden rule for the electronics industry and has economic, technological, and societal impact. Its basis you ask? To design systems and with people in mind.

In this period, the immense power of the internet, globalization and its enormous effect and of course climate change have dominated interest and conversations. Those three factors indeed were also key motivators for the automotive industry to start to react and the beginning of electrification, connectivity and mobility effectively starts there. The main technological trends of these years were the development of hybrid and electric vehicles utilizing the power of the internet to create “environmentally” friendlier technologies with lesser of an environmental impact. The industry was full of players in the HV systems from battery developers, Dc/DC invertors and other systems like KERS, turbines and a multiplicity of more.

2007 to 2010: Beginning of the Mobility era: the market was fully disruptive however the penetration of these technologies was not real in the market. At that time, they were a lot of “early majority” start-ups that were able to foresee the benefits however the business case for investment simply did not “add up”. That was mainly for two (2) reason one being Price and the Technological development of HV systems. These require a long development cycle to produce and then save and are required in volumes to make affordable to sell in a car. The second was the business model; at the time the battery technology could only give a maximum of 30 miles range. When making a large investment in battery technology in order to enjoy a “return” it is imperative to develop business models that support this idea by (for example) allowing the vehicle to recharge in an urban journey .That’s when mobility as a Service (MaaS) was born and OEMs, battery manufacturers, automotive influencers and companies who cared about CO2 impact started pushing the approach. Suddenly if you have a hybrid or electric vehicles and you develop a a sharing model the business model works.

2008 to 2011: The Connectivity starts:

This 3 years could be labelled “Apple & Google ERA - the beginning of Connectivity”. Apple has already released all their iPhones and has developed a new business model creating apps that can easy develop and upload in to an SOA. They revolutionized design, functionality and Software to create a product that makes life easier for its users surrounded by a variety of supporting apps, products and other innovations. At the same time Huawei, Android and others were following the same path, however it was Google that came along with a powerful app that can navigate you all around the world accurately with a touch of a button…Google maps. The sole fact that users (or consumers) could simply do everything via an app on their phone or on the web was attractive to the Automotive industry and push technologists in the field to do the same thing. This was also commonly demonstrated in surveys as consumers tended to show a preference to their vehicle being equally simple and technologically savvy. Automakers were trying to find partners, a number of consortiums were created (GEnivi) to understand how to integrate this tech in the vehicles. There was already a massive debate brewing as to which of these systems could be applicable in vehicles and how easy it would be to integrate them. This created a massive disruption and took over the electrification hype of the previous years. However, it strengthened the mobility movement as being more connected, more open to share and the freedom to create-develop services (apps) on as an extra service. These platforms hence helped in creating a new perspective of how companies in the automotive industry would view customer perception of ownership and identify a potential benefit for the future.

2011 to 2015: The Software Tipping point: By 2012, Vehicle operating systems have become the most complex ones in the technology sector. Consumer demand force the OEMs to reduce time to market and have a competitive product. At one point of this stage, some OEMs had over 150 ECUs in their vehicle and more SLOC that were required or could have ever been foreseen. The OEMs did not know how to adapt to the software ERA. So instead of working in their internal systems engineering process/architecture development, to create SOA systems that can could cope with all the new functionalities required for the market, they decided that the best solution was to add ECU’s and Software for every functionality that the car has.

This approach had 3 major impacts the first one being the fact that vehicles started becoming very “heavy” hence consuming a lot of energy which in turn forced some of the OEMs to re-evaluate their ways of complying CO2 regulations. CO2 regulations are a double-sided sword as they include cost penalties for the OEM but also for the consumers. The second one was that the quality of the vehicles which had arguably decreased and OEMS had to suffer the enormous costs (of sometimes even having to recall vehicles). The third one was the BOM ( Bill of Material ) were somewhat “high” so the profit margin of the vehicles was significantly reduced due to the amount of ECUs and functionalities required.

Mainly these 3 reasons contributed to vehicles becoming more expensive, their insurance hence also increasing massively along with other side costs. In addition, the CO2 regulations were so extreme that OEMs and their supply chain were massively hurt were the situation reached “point critical” and in some instances the government, automakers and insurance companies had to sit down to decide how they are going to tackle the issue.

The three main outcomes of such discussions were:

The automotive industry decides to find solutions to reduce complexity and integration timing in order to reduce “weight”, increase quality and improve time to market.Governments agree to support OEMs and the supply chain to speed up the integration and development of electrification projects (mobility, charging points, smart grid)The automotive industry would start to develop features with driver safety in mind to facilitate the reduction in insurance costs. Those features were called Advance Driver Assistance Systems (ADAS). What people commonly call autonomous driving level 0 or level 1.2015 to Today: CAV, Blockchain, AI and Big Data - The convolution of Megatrends.

In the last two years a massive shift to push technologies to the tipping point has occurred. Consumers, governments, tech companies and the investment community have collectively come together and achieved 3 – previously inconceivable – changes:

First:

The Governments start to push the penetration of autonomous and other technologically advanced vehicles with the introduction and implementation of new legislation, laws and directives. The reasons behind this shift will be discussed in future blogs the main however being CO2 regulations that push the Diesel Tariffs and consequently force every OEM to seek environmentally friendly technologies for their vehicles.Telecommunications companies and operators were put under tremendous pressure to speed up their development plans to implement 4G & 5G to enable the penetration of infrastructures for electric vehicles and the development of technology around mobility.Second:

As a technological community we realize two main breakthroughs:Firstly, that Moore’s law is not necessary to achieve the level of complexity that we need to develop future solutions. The “Digital and Embedded Software” world would come together as one collective entity with an aim to create new ecosystems in which they can co-exist and evolve as an entity. I like to call this the Terabyte marriage of Adam & Eva. Adam being the embedded Software and Eva being the Digital playful and exploring Software.Third:

Customer perception had entirely changed with people worldwide wanting to connect, share their thoughts and experiences and interact seamlessly and with minimum effort. We do not look as much as the vehicle we move, we just want to move from A to B and new technology is a key unique selling point. Today brands are focusing more on the technological innovations and additions rather than the perceived quality or looks of the product.This has enabled the development of the MCAV (Mobility Connected Autonomous Vehicle) as well as the penetration of technologies that are needed to develop the MACV like A.I., Blockchain and Big Data.

Market Disruption: One of the key Confusions

All this is quite exciting, especially if ones is passionate about technology and sociology as what we are seeing is society evolving to be more integrated with the technology and embrace it as part of their daily life. However, if you are in the areas of Early Majority or Late Majority, you are a OEM, Telecom operator or Investment Fund it is fully understandable that this complete disruption, is quite difficult to fully comprehend

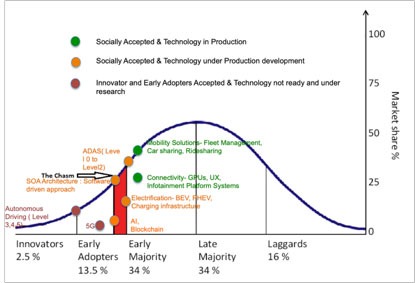

To explain it a little bit let us have a look at the Law of Diffusion of innovation that we explained at the beginning of this article and try to position some of the technologies that we have in the market today.

The graph above uses difference colors to define the level of maturity of the technology and how socially these technologies are accepted. We also describe some of the key technologies that we think will have a big impact in the MCAV market and his disruption.

Based on our experience of discussing some of these topics with the market and applying then to the Law of diffusion of Innovation the outcomes we can get are :

Currently the technological landscape is quite complex. There are too many technologies in difference stages of technical maturity, having different acceptance in the market and with different however complementary business models. Some of them are enablers of others, such as 5G, Electrification and MCAV. Some of them are more mature than others and have penetrated the market faster than others. However, it is evident that there are far too many technologies in the innovator and early adopters of this space. This is creating a massive disruption as people who understand one technology and market are not fully coherent or have a clear understanding of other technologies and markets.The interpretation and adoptions of these technologies can be a challenge and can produce misinterpretation depending at what stage of acceptance companies are. If they are Innovator or Early adopter this is seen as an era of opportunities and excitement where investment in technology is a shrewd and potentially enormously profitable move. Nonetheless, if they are between the early majority and late majority they are really confused as they see a long road with a lot of risks and even though they can envision the opportunity they are not certain how to grasp it. Then, of course, there are also some Laggards that would perceive all the above as irrational, too big a risk and of no use to the automotive industry.There a large numbers of technologies close to the tipping point, SOA architectures, Electrification, AI and Block chain that would increase the penetration of Mobility and Connectivity and would speed up the tipping point of 5G and Autonomous Driving. However the level of investment, technology development and customer acceptance of these technologies is quite slow and it can create strong entry barriers for the 5G and Autonomous driving.Other technologies could enable the growth of other technological trends and some can not live without the other. You need to have a good SOA to have a secure and safe autonomous vehicle. You need 5G to have a fully connected autonomous vehicle and Connectivity and mobility solutions.The business models and return of investment for these technological trends are quite difference and so related. An more open view need to taken to understand the full benefit of these trends. If they analyze individually they ROI and business models differ.The merge of different industries, Automotive, Telecoms, Infrastructures and Energy are creating a clash of views and changes of interactions in the market. All of these companies have different ways to analyze their business and ROI but they certainly also have a customer centric view to see the benefits. This results in a lot of confrontation due to the different set of strategies across markets.New incumbents (start-ups) appeared in the space with an ecosystem approach and with different business models - that are not the standards in the market - are also creating confusion to the classical industrial player.So, to conclude market disruption is one of the key factors of the confusion in the new Ecosystems MCAV. In the next article we will analyze how the industrial players are changing they supply chain approaches to adapt to all this disruption

David Fidalgo

CEO/Founder Y Mobility

Create – Cultivate - Connect

Why everything is confusing Part 1: Market Disruption

Modified on Thursday 20th December 2018

Find all articles related to:

Why everything is confusing Part 1: Market Disruption

Add to my Reading List

Add to my Reading List Remove from my Reading List

Remove from my Reading List