Lead the coming global mobility business

Carlo Iacovini is in charge of EMEA and Australia product management and marketing strategy for Olli, a self-driving shuttle with IBM Watson (artificial intelligence) shaping Local Motors as a technology company in autonomous driving market and new mobility services. He shares his thoughts with TaaS Technology magazine about how to lead the mobility revolution.

Strategy, pillars and operations for autonomous driving fleet management business

We are quite aware that future business model for carmakers is mobility oriented more than car focused. All brands are moving to become miles/km providers, much bigger market than struggling selling cars to dealers and customers.

Weekly news support this future.. but the focus of this post is more about the business side. How to make money in this new shaping industry?

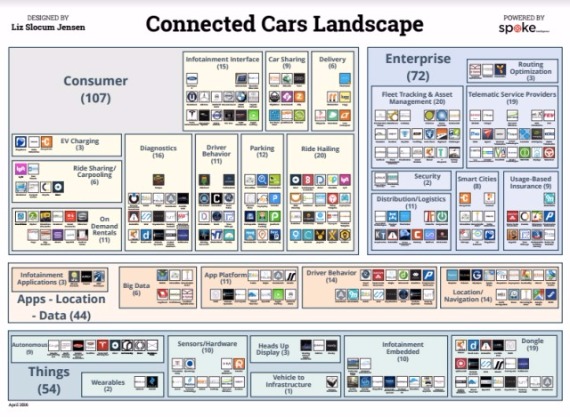

The convergence of electric and autonomous technologies, public regulations, tradeoff between public/private business, integration of fleet management, long-term and short-term rentals are disrupting multiple traditional businesses and shaping a completely new competitive arena where different industries want to play the game.

We see car makers directly moving to mobility (brand like Moia, Maven, IMotion, Moovel, Lynk&co just to mention few ones) or huge public transports operators (Deutsche-Bahn, Transdev, Keolis) extending their offer to ride-sharing pilots, or big rental companies embracing sharing mobility (corporate or privately based) and don't forget new players often heavily backed (Zoox) or leading forefront giants like Uber or Waymo.

The convergence of electric and autonomous technologies, public regulations, tradeoff between public/private business, integration of fleet management, long-term and short-term rentals are disrupting multiple traditional businesses and shaping a completely new competitive arena where different industries want to play the game.

We see car makers directly moving to mobility (brand like Moia, Maven, IMotion, Moovel, Lynk&co just to mention few ones) or huge public transports operators (Deutsche-Bahn, Transdev, Keolis) extending their offer to ride-sharing pilots, or big rental companies embracing sharing mobility (corporate or privately based) and don't forget new players often heavily backed (Zoox) or leading forefront giants like Uber or Waymo.

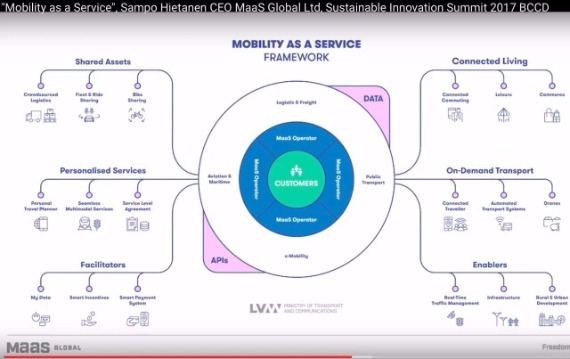

Quite a crowded arena, specially if we consider that none of those players really own the whole stack of services that future business will require. Even more if we understand that final stage of this change will be the coming popular definition "Mobility as a Service" clearly described in this picture by Sampo Hietanen, pioneer entrepreneur running his MaaS Global company.

Starting from here I outline some of the most important topics to be considered addressing this market based on assumptions that only few companies will have the resources (money, team, assets) to scale globally and we'll probably see many providers acting locally followed by an increasing number of M&A.

Quite a crowded arena, specially if we consider that none of those players really own the whole stack of services that future business will require. Even more if we understand that final stage of this change will be the coming popular definition "Mobility as a Service" clearly described in this picture by Sampo Hietanen, pioneer entrepreneur running his MaaS Global company.

Starting from here I outline some of the most important topics to be considered addressing this market based on assumptions that only few companies will have the resources (money, team, assets) to scale globally and we'll probably see many providers acting locally followed by an increasing number of M&A.

Full mobility service business case is based on a tailored range of vehicles according to client's preferences. Vehicles will feature new design (cars/van/minibus/light-freight) sedricwith multiple mobility targets. Vehicles will be initially electric and autonomous in a short timeline of period (local deployment according to regulations). In some regions it's possible to include 2 wheels in the game.

Fleet Financing (leasing/rental) will be a core business because even if we think about the future.. we'll still need someone to own and rent cars for mobility. At least until we'll move in 3 dimensions instead of 2 and flying car will hit the road.. (actually the sky) of our cities.

Business operations: the business case includes a broad range of operations:

- Vehicles management (maintenance, service, cleaning, warranties, storage/parking)

- Fleet management (software, on board unit)

- IT-Platform "“ Integration of API with third parties.

- Business user app (driver and backend system): Booking/Dispatching/Routing/Billing/customer service

- End user (consumer) app: expected to be up to Customer or fully owned if is directly operating

- Charging (fast charge daily, slow charge overnight, wireless and automated)

- Customer experience (riding experience based on entertainment/business time traveling with autonomous vehicles)

- Drivers experience (safety, eco driving, community approaches)

In the near future we'll assist to

- Integration of IT-platform with autonomous driving software and hardware.

- Integration of business case with MaaS aggregators (not only cars but also public transports and more)

- Integration of business case with logistic/freights hub

- Integration of IT platform with blockchain

Assets management and revenue streams

I addressed in my previous point some of the relevant key topics to lead future mobility business cases. I move forward now to analyse which are the assets and the revenue streams of this new business model

Managing fleet of autonomous vehicles offers the unique opportunity to use a series of assets to increase the value of the business and develop multiple collateral business cases linked with the operations.

Each asset can be owned/acquired/leased/ to run the business case and create more revenues streams

Real estate

Storage and parking. Having access to storage hubs and parking infrastructures will be a key factors when we'll have thousands of vehicles running.

Full mobility service business case is based on a tailored range of vehicles according to client's preferences. Vehicles will feature new design (cars/van/minibus/light-freight) sedricwith multiple mobility targets. Vehicles will be initially electric and autonomous in a short timeline of period (local deployment according to regulations). In some regions it's possible to include 2 wheels in the game.

Fleet Financing (leasing/rental) will be a core business because even if we think about the future.. we'll still need someone to own and rent cars for mobility. At least until we'll move in 3 dimensions instead of 2 and flying car will hit the road.. (actually the sky) of our cities.

Business operations: the business case includes a broad range of operations:

- Vehicles management (maintenance, service, cleaning, warranties, storage/parking)

- Fleet management (software, on board unit)

- IT-Platform "“ Integration of API with third parties.

- Business user app (driver and backend system): Booking/Dispatching/Routing/Billing/customer service

- End user (consumer) app: expected to be up to Customer or fully owned if is directly operating

- Charging (fast charge daily, slow charge overnight, wireless and automated)

- Customer experience (riding experience based on entertainment/business time traveling with autonomous vehicles)

- Drivers experience (safety, eco driving, community approaches)

In the near future we'll assist to

- Integration of IT-platform with autonomous driving software and hardware.

- Integration of business case with MaaS aggregators (not only cars but also public transports and more)

- Integration of business case with logistic/freights hub

- Integration of IT platform with blockchain

Assets management and revenue streams

I addressed in my previous point some of the relevant key topics to lead future mobility business cases. I move forward now to analyse which are the assets and the revenue streams of this new business model

Managing fleet of autonomous vehicles offers the unique opportunity to use a series of assets to increase the value of the business and develop multiple collateral business cases linked with the operations.

Each asset can be owned/acquired/leased/ to run the business case and create more revenues streams

Real estate

Storage and parking. Having access to storage hubs and parking infrastructures will be a key factors when we'll have thousands of vehicles running.

Garages for car services. Traditional car dealers and services will shift their core business from privates or direct customers to fleet and an efficient and fast organisation will optimise the operations

Charging hubs (Renewable powered, smart grid, vehicle2grid applications). Grid balance in cities will be an issue and those players with direct access to infrastructures will be facilitated. Energy will be the new "oil" and its availability can be improved thanks to renewable power.

Big data

Among world top ten brands as per capitalisation (Amazon, Apple, Google,) and in mobility also (Uber) there are companies owning huge amount of data. Big data will be a mainstream revenue stream for those able to monetise and create value from that. Transport and mobility provide a relevant amount, coming from the following areas:

Garages for car services. Traditional car dealers and services will shift their core business from privates or direct customers to fleet and an efficient and fast organisation will optimise the operations

Charging hubs (Renewable powered, smart grid, vehicle2grid applications). Grid balance in cities will be an issue and those players with direct access to infrastructures will be facilitated. Energy will be the new "oil" and its availability can be improved thanks to renewable power.

Big data

Among world top ten brands as per capitalisation (Amazon, Apple, Google,) and in mobility also (Uber) there are companies owning huge amount of data. Big data will be a mainstream revenue stream for those able to monetise and create value from that. Transport and mobility provide a relevant amount, coming from the following areas:

- Mobility patterns (Matrix o/d)

- Mapping data (for autonomous driving software applications)

- Driving data (travel behaviour, drivers behaviour in different environment, incentives for drivers, privacy policies)

- Fleet data/Insurance

- Artificial intelligence for mobility and user experience

Fleet

Cars are not only the main asset for running the operations as there are multiple options to get value from the vehicle:

- Mobility patterns (Matrix o/d)

- Mapping data (for autonomous driving software applications)

- Driving data (travel behaviour, drivers behaviour in different environment, incentives for drivers, privacy policies)

- Fleet data/Insurance

- Artificial intelligence for mobility and user experience

Fleet

Cars are not only the main asset for running the operations as there are multiple options to get value from the vehicle:

Financial asset. Financing the fleet allows to have interest gain

Second life Battery pack strategies (link to storage business model). The batteries of the vehicles can shift into a second life plan to re-market them at the end of the first lifecycle for storage and other utilisations.

Marketing. On purpose vehicles are a branding tool (as Moia just proved with their launch few days ago)

Commercial (promotion and re-marketing). Vehicles can generate more revenue once we move them into the re-marketing plan and second sales.

Entertainment

What shall we do during our trips in autonomous cars? Many operators are raising this questions and pay per use services (entertainment/business) to be developed for self driving cars seems to be a collateral area of interest. Whether we use our subscriptions (Netflix, Spotify and similar), I bet many services will be integrated directly in the cars.

Financial asset. Financing the fleet allows to have interest gain

Second life Battery pack strategies (link to storage business model). The batteries of the vehicles can shift into a second life plan to re-market them at the end of the first lifecycle for storage and other utilisations.

Marketing. On purpose vehicles are a branding tool (as Moia just proved with their launch few days ago)

Commercial (promotion and re-marketing). Vehicles can generate more revenue once we move them into the re-marketing plan and second sales.

Entertainment

What shall we do during our trips in autonomous cars? Many operators are raising this questions and pay per use services (entertainment/business) to be developed for self driving cars seems to be a collateral area of interest. Whether we use our subscriptions (Netflix, Spotify and similar), I bet many services will be integrated directly in the cars.

If those are some of the assets to be leveraged in future mobility business, there is an complementary strategy to address which seems to be the big umbrella where including the whole stack of innovation: MaaS: mobility as a service. Once the volume of ridesharing trips will really shift our cities mobility patterns we have to expect that large corporations will aggregate vertical players to create the biggest platform to really go from A to B with one touch. Many are competing already around the world and capitalisations will drive the winning ones.

East regions (China, Malaysia, India) faces deregulated market where new mobility services (ride sharing/ride hailing) have established brands like DIDI (China) Grab (Malaysia) Careem (Middle east) OLA (india). Many of them have international growth plans or even to extend operations (Didi just announced 151M$ investment to enter the car sharing market).

West regions (USA/Canada). is the cradle of new mobility and player are competing at the forefront of innovation thanks to most famous brands Uber/Lyft, Waymo/Apple.

If those are some of the assets to be leveraged in future mobility business, there is an complementary strategy to address which seems to be the big umbrella where including the whole stack of innovation: MaaS: mobility as a service. Once the volume of ridesharing trips will really shift our cities mobility patterns we have to expect that large corporations will aggregate vertical players to create the biggest platform to really go from A to B with one touch. Many are competing already around the world and capitalisations will drive the winning ones.

East regions (China, Malaysia, India) faces deregulated market where new mobility services (ride sharing/ride hailing) have established brands like DIDI (China) Grab (Malaysia) Careem (Middle east) OLA (india). Many of them have international growth plans or even to extend operations (Didi just announced 151M$ investment to enter the car sharing market).

West regions (USA/Canada). is the cradle of new mobility and player are competing at the forefront of innovation thanks to most famous brands Uber/Lyft, Waymo/Apple.

Europe: is an highly regulated market and new mobility struggles to become real in terms of volumes. Further than direct business development a potential strategy to fast the process in the early stage is to link with public transport operators or car manufacturers that are familiar with regulations and they are entering in the mobility arena. Business development is subject to local/national Government approval even if EU policies are expected within few years time to create the legal framework.

So there's a lot to do and we can be sure that mobility, public transport industry and automotive will converge in a whole new competitive arena that we don't know the boundaries yet.

Europe: is an highly regulated market and new mobility struggles to become real in terms of volumes. Further than direct business development a potential strategy to fast the process in the early stage is to link with public transport operators or car manufacturers that are familiar with regulations and they are entering in the mobility arena. Business development is subject to local/national Government approval even if EU policies are expected within few years time to create the legal framework.

So there's a lot to do and we can be sure that mobility, public transport industry and automotive will converge in a whole new competitive arena that we don't know the boundaries yet.

Lead the coming global mobility business

Modified on Monday 12th February 2018

Find all articles related to:

Lead the coming global mobility business

Add to my Reading List

Add to my Reading List Remove from my Reading List

Remove from my Reading List